Earned Value Management (EVM), a tried-and-true project management technique, can be adapted to enhance FinOps Cloud Cost Management. Although EVM was designed for project execution, its principles can be leveraged to improve tracking, control, and forecasting of cloud costs. In this article, we discuss how EVM strengthens financial visibility, optimizes resource use, and aligns cloud spending with business objectives.

Where EVM Fits in FinOps

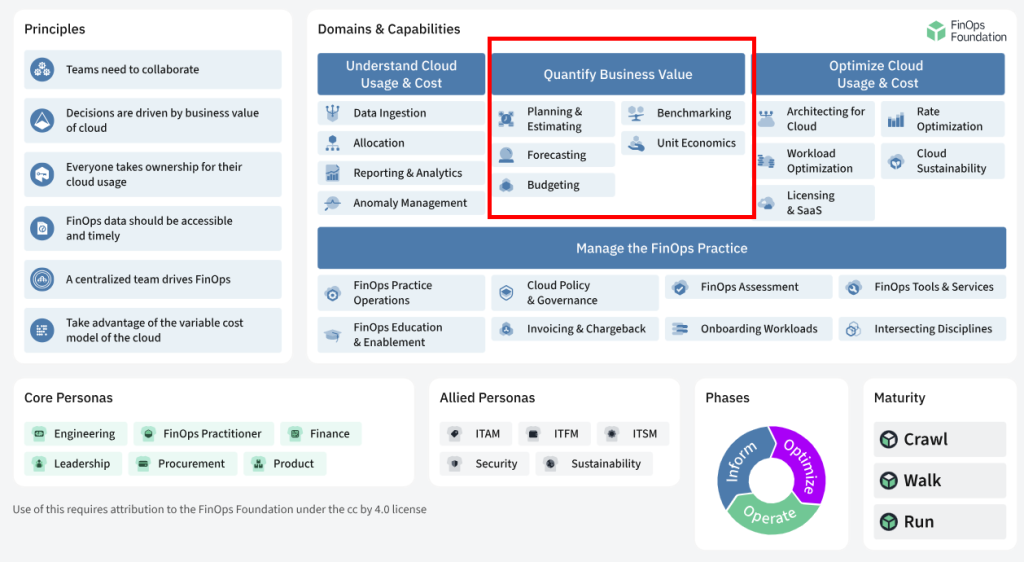

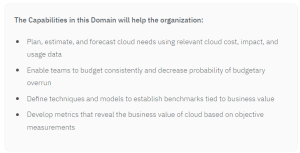

FinOps is a broad discipline, and it’s helpful to clarify where EVM fits within the framework. EVM aligns closely with the “Quantify Business Value” domain, which emphasizes tracking cloud costs in relation to business value.

In the “Quantify Business Value” domain, EVM offers a structured method to achieve this alignment. By understanding how cloud expenditures contribute to outcomes, EVM reinforces this FinOps capability, adding significant value.

From FinOps Quantify Business Value Domain

“You make different colors by combining those colors that already exist.” —Herbie Hancock

What is EVM?

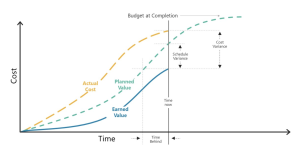

Earned Value Management (EVM) is a project management method that integrates cost, schedule, and performance metrics. It offers a comprehensive view of project progress by comparing the value of completed work against the planned budget and schedule. EVM allows for informed decision-making, proactive corrections, and outcome prediction.

Origins of EVM

EVM originated in the 1960s, developed by the U.S. Department of Defense for managing complex defense projects like the Polaris Missile Program. EVM has since been embraced across various sectors, including construction, engineering, software development, and IT.

Several institutions, such as the US DoD, NASA, the UK Ministry of Defense, and PMI, employ EVM in project management.

Key Components of EVM

- Planned Value (PV): Also known as Budgeted Cost of Work Scheduled (BCWS), PV represents the approved budget for planned work, defined during project planning.

- Earned Value (EV): Known as Budgeted Cost of Work Performed (BCWP), EV reflects the value of completed work based on task or deliverable completion.

- Actual Cost (AC): Also called Actual Cost of Work Performed (ACWP), AC indicates the true costs of completed work, gathered from financial records.

Adapting EVM to FinOps

Recognizing the Differences

EVM operates within project timelines, while FinOps deals with continuous cloud operations. A few distinctions:

- Time Span: EVM works on project timelines, whereas FinOps spans an entire budget cycle, often annually.

- Percent Complete: In EVM, progress reflects project completion; in FinOps, it relates to planned vs. actual unit economics (e.g. cost per order).

Applying EVM Concepts

- Planned Value (PV): PV in FinOps represents the budgeted cost for cloud resources over a budget cycle, typically an annual plan.

- Earned Value (EV): EV equates to the actual value of consumed cloud resources, aiding progress measurement against budget.

- Actual Cost (AC): AC tracks actual cloud spending, offering insights on cost efficiency by comparing AC to EV.

- Cost Performance Index (CPI): This ratio (EV/AC) signals cost alignment, where CPI < 1 indicates overspending.

- Schedule Performance Index (SPI): Measures cloud consumption rate (EV/PV), with SPI < 1 signaling inefficiencies.

Assumptions for Effective EVM

Certain prerequisites enhance EVM’s effectiveness in FinOps:

- Unit Economics Definition: In “Quantify Business Value,” establishing a target unit economics figure is vital, such as cost per order for the year.

- Budget Establishment: Defined budgets support PV calculation, ideally divided monthly in yearly budget cycles. PV reflects cumulative budget up to the current month.

Earned Value, % Complete and Unit Economics

Earned Value (EV) is the result of Planned Value (PV) times %Complete. Remember that both EV and PV are cumulative for the assessing period. By assessing period, we mean the “the cumulative amount until the month we are doing the analysis”. For example, PV of March is the cumulative amount of the 3 first months of the year.

For FinOps, % Complete is the relation between Unit Economic on the assessing period with the target Unit Economic. For example, in March, our cumulative cost per order is $0.54 and our target cost per order is $0.50.

Calculating Earned Value Management.

Let’s use a simple example to demonstrate how this can be calculated. Consider a budgeting cycle of a year, starting in January and finishing in December. For simplicity, consider that the monthly spend is estimated at $100 flat. PV is the cumulative amount at any given month.

Scenario 1 – Under Budget.

Consider that we are assessing the month 5 (May) and that the calculated figures of %Complete, Actual Cost and cumulative Actual Cost (AC) are as follow:

Let’s put these numbers in a graph and discuss it a little further.

The cost variance is the difference between Earned Value and Actual Cost. This is the real value that we have earned up until that point in time.

Cost variance formula

Cost Variance in this example, equals to $325. If Earned Value were not calculated, we would only have the normal comparison of Actuals vs. Plan, that would be $100. It is a good result, but not as good as the real situation is. Earned Value takes into consideration the business result by accounting expected and real Unit Economics.

Earned Value takes into consideration the business value by accounting expected and real Unit Economics.

Scenario 2 – Over Budget

Now let’s consider that, although PV and AC are the same, %Complete went differently, as unit economics were not according to what was expected.

Monthly progression until May

Monthly progression until May and Cost Variance

If only Actuals and Plan were considered, we could be deceived by the apparent positive result of $25 under. But in reality, when we compare Actuals (AC) against Earned Value, we will see that we are actually $150 over. In other words a negative Cost Variance of -$150.

The conclusion of this scenario is that, although we are spending less than what was planned, we are not reaching the expected business value due to a negative cost variance.

Estimating EVM accurately

Accurate estimation of Earned Value (EV) is essential for effective Earned Value Management (EVM). Let’s break down the steps to estimate EV accurately:

Determine Percent Complete:

- In this technique, the percent complete will be tied to the Unit Economics.

- A target Unit Economic should be determined in advance. Normally it can be done as part of the budgeting exercise and should be reviewed on a periodic basis.

- Assess the Unit Economic for the reporting period. For more advanced teams, determine the Unit Economic specifically for the team. Determine what percentage compared with the target stablished for the team/product/area/etc. This step provides the foundation for calculating EV.

Planned Value (PV):

- PV represents the planned budget for the work completed up to a specific point in time. It’s the value of work that was scheduled to be done.

- In FinOps context, it is simply the budget amount for any given specific day, on the lowest level available.

Earned Value (EV):

- EV measures the actual value of what has been delivered from products and services on the cloud. It reflects the progress achieved.

- Earned Value (EV) is the result of Planned Value (PV) times %Complete. Remember that both EV and PV are cumulative for the assessing period. By assessing period, we mean the “the cumulative amount until the month we are doing the analysis”. For example, PV of March is the cumulative amount of the 3 first months of the year.

Actual Cost (AC):

- AC represents the actual cost incurred for the assessing period. Obtain this information from cloud billing data.

- AC is the total cost spent up to the current point in time.

- Make sure that AC comes from data that is correctly mapped within your reporting system. Also make sure that the period assessed contain the entire Actual cost, as some costs may take a few days to show on reports.

Cost Variance (CV):

- CV shows whether the project is under or over budget.

- Calculate CV using the formula:

CV = EV – AC

Cost Performance Indicator

Cost Performance Indicator (CPI) is obtained by dividing Earned Value (EV) by Actual Cost (AC).

Cost Performance Indicator Formula

If we apply this formula for the two scenarios, here is what we get:

CPI for Scenarios 1 and 2

So, for Cost Performance Indicator, if:

- CPI is higher than 1, we are spending less to achieve business results.

- CPI is lower than 1, we are spending more and missing the target.

- CPI is equal 1, we are progressing according to the plan.

Turns out that CPI becomes a good indicator as with just one number we are able to know if our cloud spend is delivering the value expected.

Why FinOps EVM CPI Matters

Understanding EVM CPI

As mentioned above, CPI is a metric derived from Earned Value Management (EVM), a project management technique that integrates cost, schedule, and performance data. It provides insights into how efficiently a project or initiative is utilizing its budget. Specifically, EVM CPI compares the earned value (the value of work completed) to the actual cost incurred. The formula for EVM CPI is:

EV = Earned Value | AC = Actual Cost

- If CPI > 1: The project is performing well within budget.

- If CPI = 1: The project is on budget.

- If CPI < 1: The project is over budget.

Translating the above to FinOps Business Value context:

- If CPI > 1: Business Value is higher, compared to budgeted Cloud cost.

- If CPI = 1: Business Value is expected compared to budgeted Cloud cost.

- If CPI < 1: Business Value is lower, compared to budgeted Cloud cost.

When executives finally grasp the concept of FinOps EVM CPI and truly understand its implications, they gain the power to instantly gauge the success or failure of a project or initiative in terms of delivering Business Value. The ability to swiftly evaluate current cloud spending is invaluable. The mere existence of this KPI, and its accurate calculation, signifies that the fundamental processes for managing cloud costs are, at the very least, in place to offer this concise measurement that empowers well-informed decisions.

Applying FinOps EVM CPI to Cloud FinOps

Cloud Cost Optimization

In the context of cloud computing, EVM CPI becomes a powerful tool for FinOps (Financial Operations) leaders. Here’s why:

- Cost Efficiency: EVM CPI helps organizations assess whether their cloud spending aligns with the value delivered. A high EVM CPI indicates efficient utilization of cloud resources, while a low EVM CPI signals potential waste or overspending.

- Resource Allocation: By tracking EVM CPI, leaders can allocate resources effectively. If a specific cloud service or workload consistently shows a low EVM CPI, it warrants investigation. Perhaps there’s an opportunity to optimize resource allocation or choose a more cost-effective solution.

Cloud Business Value Measurement

- Business Alignment: EVM CPI directly ties financial performance to business outcomes. Leaders can evaluate whether cloud investments are translating into tangible business value. For example, if a new feature deployment has a high EVM CPI, it suggests that the investment is paying off.

- Decision Making: EVM CPI informs strategic decisions. Leaders can prioritize projects based on their EVM CPI scores. Initiatives with a positive EVM CPI may receive additional funding, while those with a negative EVM CPI may require adjustments or re-evaluation.

Challenges and Considerations on CPI

Data Accuracy

- Accurate data is essential for calculating EVM CPI. Leaders must ensure that cost and performance data are up-to-date and reliable. Here, the FinOps team has an important role to play, in order to ensure that the processes and practices are properly followed.

Contextual Interpretation

- EVM CPI should be interpreted in context. A low EVM CPI doesn’t automatically indicate failure; it might be acceptable if the project is in an early stage or if certain costs are front-loaded.

Estimating FinOps EVM accurately

Accurate estimation of Earned Value (EV) is essential for effective Earned Value Management (EVM). Let’s break down the steps to estimate EV accurately:

Determine Percent Complete:

- This is the most important part. On FinOps EVM the percent complete will be tied to the Unit Economics.

- A target Unit Economic should be determined in advance. Normally it can be done as part of the budgeting exercise and should be reviewed on a periodic basis.

- Assess the Unit Economic for the reporting period. For more advanced teams, determine the Unit Economic specifically for the team. Determine what percentage compared with the target stablished for the team/product/area/etc. This step provides the foundation for calculating EV.

Determine Planned Value (PV):

- PV represents the planned budget for the work completed up to a specific point in time. It’s the value of work that was scheduled to be done.

- On FinOps context, it is simply the budget amount for any given specific day, on the lowest level available.

Determine Earned Value (EV):

- EV measures the actual value of what has been delivered from products and services on the cloud. It reflects the progress achieved.

- Earned Value (EV) is the result of Planned Value (PV) times %Complete. Remember that both EV and PV are cumulative for the assessing period. By assessing period, we mean the “the cumulative amount until the month we are doing the analysis”. For example, PV of March is the cumulative amount of the 3 first months of the year.

Determine Actual Cost (AC):

- AC represents the actual cost incurred for the assessing period. Obtain this information from cloud billing data.

- AC is the total cost spent up to the current point in time.

- Make sure that AC comes from data that is correctly mapped within your reporting system. Also make sure that the period assessed contain the entire Actual cost, as some costs may take a few days to show on reports.

Other EVM Indicators:

Besides CV and CPI, consider other indicators:

-

- Cost Performance Index (CPI): CPI = EV / AC

- Estimate at Completion (EAC): EAC estimates the total cost of budgeting period based on current performance.

- Estimate to Complete (ETC): ETC estimates the remaining cost needed to complete the budgeting period.

- Budget at Completion (BAC): Simply the total cost of the budget period.

- To-Complete Performance Index (TCPI): TCPI = (BAC – EV) / (BAC – AC)

- Schedule Variance (SV): CV = EV – PV. It is the cost of the actual schedule state (delayed or ahead of schedule).

Conclusion

EVM applied to FinOps may seem new, but its established methods enrich cloud cost management by quantifying cost against expected business results. While not a magical figure, the EVM CPI indicator simplifies progress assessments, helping FinOps teams stay aligned with business goals.

Integrating EVM into cloud FinOps hinges on maturing capabilities like Planning & Estimating and Unit Economics. But over time, as these capabilities evolve, EVM will naturally align FinOps practices, supporting leaders and practitioners in achieving business objectives across the “Quantify Business Value” domain.