Digital transformation is in full swing, as organisations are becoming ‘tech first’ businesses; in many cases reviewing and changing their whole business models to ensure they put their clients’ needs first.

We have seen a 300% increase in the number of applications available to organisations since 2010. As a result, IT resellers are having to pivot to ensure that they can provide the right level of reporting on software licensing for their clients.

Initially many people felt that online market places were going to cannibalise a large percentage of the IT resellers revenue. What we’ve discovered at Appstrato is that this has driven innovation and value add reporting in the reseller community. Let’s take a closer look at the situation.

Historically, software reporting has been fairly basic for many IT resellers. Focussing on the core applications as this is where 80% of the cost has traditionally sat. However, as software consumption and licensing models have changed there has been a sharp increase in demand for comprehensive software reporting from end users. Put short internal Procurement teams are overrun with the shear volume of applications and vendors that businesses are now using, and the tail end spend is more like a ‘full body’ of spend that cannot be ignored anymore.

IT resellers have historically struggled to provide comprehensive and detailed licence reporting on all software purchased; there have been many reasons for this; but we have highlighted the key ones below:

Lack of centralized tracking: Many resellers might not have a centralized system in place to track and manage their sales. This can lead to difficulties in gathering accurate and up-to-date information on the software they have sold.

Complex licensing models: Some software products have intricate licensing models that can be challenging to keep track of. Different licensing tiers, versions, and add-ons can make it difficult for resellers to accurately report on what exactly they have sold to each client.

Inefficient record-keeping: Poor record-keeping practices can cause confusion and difficulties when trying to report on sales. If information about sales, licenses, and clients is scattered across various systems or even on paper, consolidating the data can be time-consuming and error-prone.

Manual processes: If resellers rely on manual processes for recording sales and managing licenses, there is a higher risk of human error, leading to discrepancies in their reports.

Lack of integration: Resellers often work with multiple vendors and may sell different software products. If the systems for each product are not integrated or do not communicate with each other, it becomes challenging to generate comprehensive reports.

Volume of transactions: Some resellers deal with a high volume of transactions, making it difficult to keep track of every sale accurately. The sheer number of clients, products, and licenses can lead to oversights and difficulties in reporting.

Data privacy and compliance concerns: Resellers may face challenges in aggregating and reporting sales data due to data privacy and compliance regulations. Sharing client information without proper consent or in violation of relevant laws could result in legal issues.

Inadequate training: If reseller employees are not adequately trained on how to manage sales and reporting processes, it can lead to mistakes and inaccuracies in the reports.

Time constraints: Resellers may prioritize sales and customer support, leaving less time and attention for proper reporting and record-keeping.

Overall, a combination of operational, technological, and organizational factors can contribute to the struggles of software resellers in accurately reporting on what software they have sold to their clients. To improve reporting, resellers are starting to invest in efficient tracking systems, implement streamlined processes, and provide adequate training to their staff. In essence they are digitally transforming elements of their core business to put their clients front, centre and back of their purpose.

However, at the heart of the problem has been cost of technology; most traditional software management technologies or licence platforms have been built to deliver value to the end user; not a reseller.

Over the past 5 years digital marketplaces have rapidly gained a certain level of attraction; certainly, during Covid they provided a real quick fix for end users that needed simple access to purchasing applications.

Digital marketplaces have definitely disrupted traditional business models across various industries, including IT reselling. However, whether they will completely “win” the war with traditional IT reseller is a complex question that depends on several factors. Let’s explore some key points:

Competition and pricing: Digital marketplaces often offer a wide range of products and services at competitive prices. This can put pressure on traditional IT resellers, especially if they cannot match the pricing due to higher overhead costs.

Ease of access: Digital marketplaces provide a convenient and accessible platform for buyers to find and purchase software and IT solutions. This ease of access can attract customers away from traditional resellers, who may have limited visibility compared to online marketplaces.

Diverse product offerings: Digital marketplaces typically offer a vast selection of software and IT solutions from various vendors. This diverse product range can be appealing to customers looking for one-stop shops for their IT needs.

Customer preferences: Some customers may prefer the convenience of purchasing software directly from a digital marketplace, while others may still value the personalized service and expertise provided by traditional IT resellers.

Value-added services: Traditional IT resellers often offer value-added services such as consulting, integration, customization, and ongoing support. These services can differentiate them from digital marketplaces, which may focus primarily on product sales.

Relationship-based selling: Established IT resellers may have strong relationships with their clients, built on trust and understanding of their specific needs. These relationships can be challenging for digital marketplaces to replicate.

Specialized markets: In certain niche markets or industries, traditional IT resellers with specialized knowledge and expertise may continue to thrive, as they can address unique challenges that may not be fully covered by digital marketplaces.

Regulatory factors: Some industries or regions have specific regulations and compliance requirements that may necessitate personalized solutions and services, favouring traditional IT resellers.

In summary, while digital marketplaces have disrupted the traditional IT reseller model, their ongoing impact will reduce as organisations seek increased support services and local partnerships to further their transformation programmes. Both models have their strengths and weaknesses, and the future will likely involve a blend of digital marketplaces and traditional resellers coexisting in the IT industry.

One thing is for certain, IT resellers that can digitally transform their own internal software licence reporting capabilities will win the battle against online marketplaces. In fact, at Appstrato we would go as far as to say that IT resellers that can provide detailed and accurate software licence reporting alongside their value-add services will thrive in this new digital first economy. The most recent examples of this ‘play’ are SoftwareONE with PyraCloud, Trustmarque using Livingstone’s internal tool called LUCE and Bytes after buying Phoenix have access to Dashboard.

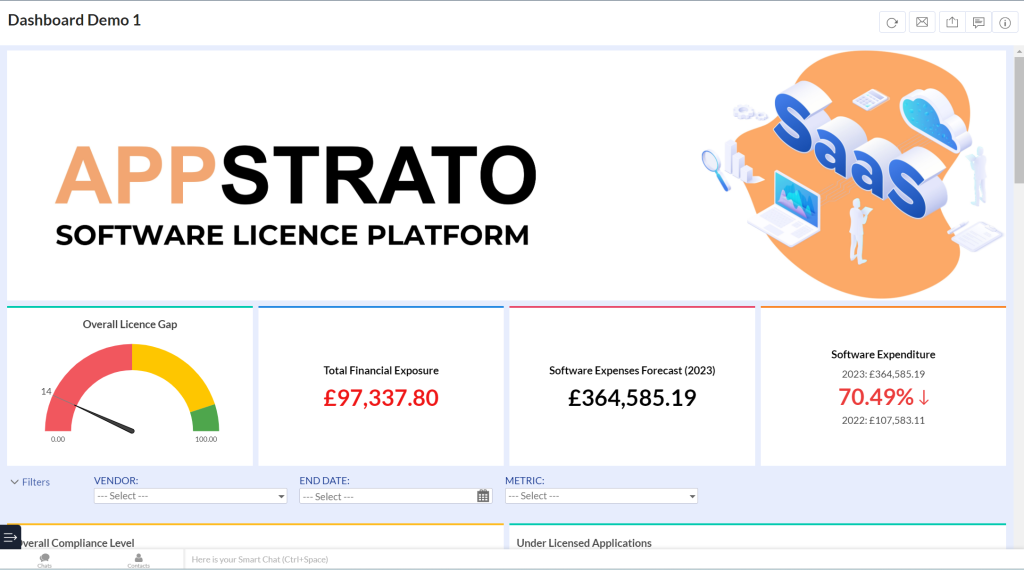

Of course, not every reseller will be able to build their own internal software licensing system or buy another company to attain the required technology. This is where Appstrato believes it can fit into the value chain.

Appstrato’s intelligent software hub was designed to help IT resellers provide cost efficient and insight driven software licence reporting. By digitising the reporting process, resellers are able to record all licence information at point of procurement and in one central place. The end result – customers are able to visualise what they have purchased, the licence details, renewals and associated costs. A solution to an age old problem that has hindered the IT reseller community for many years.